Four Trends Shaping Material Handling in 2022 and Beyond

With the coronavirus still shadowing everyday life, a great deal of uncertainty hangs over the material handling industry as we move into 2022. Yet, the industry can’t wait for that uncertainty to clear before making the investments required to enable supply chains to adapt to the changes occurring in the market. That should make 2022 another busy and dynamic year for warehouse operators and their automation partners. Here are four macro trends that we expect in the coming year.

1. Item picking moves upstream

2. Grocery retailers crystallize their MFC strategies

3. Supply chain connectivity begins to deliver global inventory visibility

4. Flexibility drives warehouse automation decisions

The material handling industry has seen unprecedented change over the last several years. Responding to those changes in real time was often an all-consuming task that delayed longer term planning. Now, as we enter 2022, many organizations will find they simply can’t stretch their available resources and systems any further. New distribution strategies and technologies are required to meet the challenges of today and to adapt to the unforeseen changes of the future.

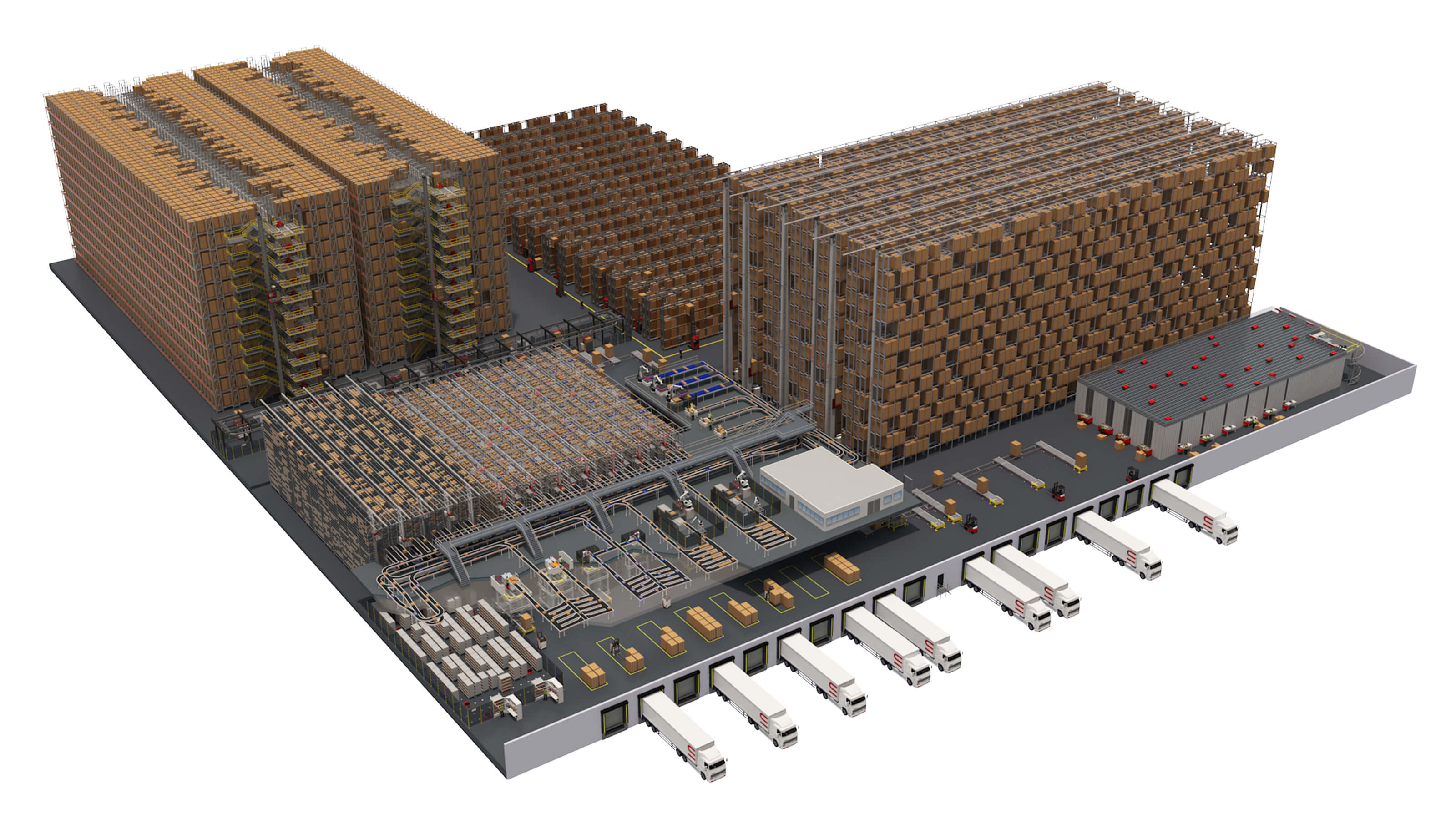

AutoStore offers superior density, throughput, and availability for warehouses. Powered by Swisslog’s SynQ software, it provides significant ROI where applicable, although it isn’t right for everyone.